Interested in buying property tax liens? Many investors are amazed at how simple it is to get very high interest rates when buying property tax liens, and Ted will tell you all about it.

The topics covered in “Earn Up to a Whopping 36% Buying Property Tax Liens” are:

- Get High Interest Rates From Tax Lien Certificates

- Houses vs. Residential Lots When Buying Tax Liens

- A $15,000 Lot for $100 at a Tax Lien Auction!

- Buying Tax Liens in Texas

- Buying Tax Liens in Georgia

- Know the Rules When Buying Tax Lien Property

Want to learn how to purchase bargain real estate? Would you like to buy mortgage-free property for pennies on the dollar? Or earn double-digit interest rates secured by real estate? Then take advantage of this FREE Gift.

Get High Interest Rates From Tax Lien Certificates

Many investors are amazed at how simple it is to get very high interest rates when buying property tax liens in the United States.

What separates the average investor from the exceptional investor? Knowledge and education is the answer. The more you understand about the opportunity you have buying property tax liens, property certificates, the more profitable you’ll be.

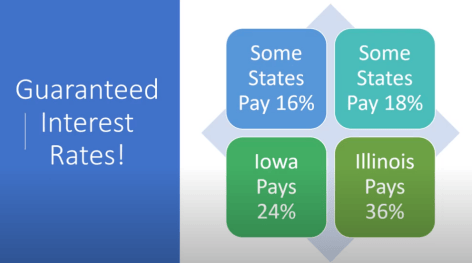

I mentioned Arizona because that’s an easy one for people here to get to, a couple of hours and you’re there, okay. They pay 16% there.

In Illinois, in the first 6 months they pay 18%, and then there’s another 18% in the next 6 months. So some of you remember that, and of course, if you tell this to anybody, they say wait a minute this can’t be. This is too good to be true.

In Georgia, we have an expert in our group from Georgia, that’s Bob Schumacher, and he’s going to tell you about Georgia.

Now he has done a hundred deals, and he started out buying tax lien certificates and now he buys both. He and I have very much the same philosophy.

Houses Vs. Residential Lots When Buying Tax Liens

I don’t go out and chase down houses, but I go out and try to find residential lots.

The reason I like residential lots, and I’ll give you a whole class on this tomorrow, is because everybody in this room grew up in a house, lives in a house, maybe born in a house, die in a house, whatever, they know houses.

So what do they do? They go out to try to buy houses. Nothing wrong with that except what happens if we get about 120 or 140 people in this room right now, and we all go start bidding on houses?

What’s going to happen to the value? What’s going to happen to prices? They’re going to start pushing up.

So you come to an auction room with a whole group like this, and those people are going to bid on houses. They’ll all bid on the house, and they’ll bid on the residential land.

A $15,000 Lot for $100 at a Tax Lien Auction!

So you’re going to get to meet Bill, and he bought like 30 properties in the last 12 months, residential lots. For some he’s paying 100 bucks, and they have a value of $15,000. You suppose he will make some money this year?

Okay, I won’t steal his thunder, but when he gets up and speaks, you’ll see. And he’ll show you where he started, and he’ll show you how he did all that.

So you’re going to be the beneficiary of all that in the next couple of days. Because they’re going to tell you how they did it.

Now are they going to stand up here and be fancy speakers? No, they’re going to get up here and tell you like it is. So you’re not going to get the maple syrup version of this, okay? You’re going to get the down-to-earth one.

Now, Iowa’s a state that pays as much as 2% every single month that the certificate is unpaid.

So it’s a great way to buy a certificate and just hope that they never come in and pay this certificate. As a matter of fact, you’ll probably pray that they don’t pay their certificate.

I have a free gift for you that will show you how to profit from buying property tax liens and reveal the secrets of tax deed investing, and I’ll also include an auction list. Get it all now for FREE.

Buying Tax Liens in Texas

We are going to start, and this is going to be the first class that will get to do it.

We are going to start, and this is going to be the first class that will get to do it.

We’re going to start taking people to the auction in Texas. All my exes are in… There you go. So Texas works like this. You bought the certificate, and that started the clock ticking.

So when that clock starts ticking, that person that didn’t pay their tax, and you did, when that happens they have 180 days to pay.

So any time they come in, in 180 days. Any time, day 1, day 21, day 51. Whatever day they come in and pay, they have to give you back all of your money plus 25%. Is that a good rate of return?

Okay, so that’s a great rate of return. You can make really good money there. But if they don’t pay you on this 180th day, then you can go to the auction and you can actually buy a property.

So a place like Harris County that happens to be in Houston, they’ll have an average close to 200 properties every month that they’ll auction.

How often? Would that work for you? Wouldn’t it be fun to have someone take you to the auction? Wow, that would be good. Okay, so you’re kind of getting the idea.

Buying Tax Liens in Georgia

Now my favorite state happens to be Georgia. The reason I like Georgia is if I bought a certificate today, they have 1 year to pay me. So any day they come in and pay, I make 20%. So that’s a good rate of return.

Now my favorite state happens to be Georgia. The reason I like Georgia is if I bought a certificate today, they have 1 year to pay me. So any day they come in and pay, I make 20%. So that’s a good rate of return.

At that point at the end of a year, you could actually start a foreclosure process and start taking the property away if you want.

Or if you didn’t take it away, they would come in and pay you the taxes as soon as you give them a notice you’re going to take it.

I tell people don’t do anything on that 365th day. Let it go the next year. Because the next year you’ll make 30%, and the year after that 40% and the year after that, you make 50%.

So those are great rates of return, and the cheque comes from Ted Thomas? No. All right, so 30% in the second year. You’re kind of getting it.

Know the Rules When Buying Tax Lien Property

We’ve got 2 systems that we’re going to learn about. Each one of the people is going to teach you all something a little bit different. They’re going to say it differently because they did it differently.

So if someone is talking about New York, is that Arizona? Okay, so Manitoba is different than Alberta, right? Alberta is different than Ontario, so they could have different rules.

When the republic was created, it started out with a few little colonies on the East Coast, and then they kept stealing from the Indians and whoever else.

They stole, California from the Mexicans. They did all that. As they stole that settlement, then they formed states.

Those states each had different rules, and until Eisenhower became the president, all the states were independent. The police would come right up to the border of that state and stop. They couldn’t go into the next state.

It wasn’t a union in the sense that they all had the same rules. So the rules are different, and the person that knows the rules in this business is going to make the most money. Let me say that again; that might be a note to write down:

The person that knows the rules is the one that’s going to make the most money.

Conclusion

You can get amazingly high interest rates from buying property tax liens, even as high as 36%. The process itself is simple, but it’s a matter of doing your homework and knowing the rules.

Each state has a different set of rules for buying property tax liens, as we saw when we took a closer look at Arizona, Illinois, Iowa, Texas, and Georgia.

However, though the rules for each state, and even per county, may be different, I can show you how to work this variety of rules to your advantage.

If you’d like to learn how to reap huge rewards from buying property tax liens, Ted Thomas provides full support and complete training with home study courses, Q&A webinars, live tutorials, workshops, web classes, and personal coaching with certified coaches.

Get started today by taking advantage of this Free Gift from Ted. Act now, it costs you nothing and will give you a big head start!

Ted Thomas is America’s Leading Authority on Tax Lien Certificates and Tax Deed Auctions, as well as a publisher and author of more than 30 books. His guidebooks on Real Estate have sold in four corners of the world. He has been teaching people just like you for over 30 years how to buy houses in good neighborhoods for pennies on the dollar. He teaches how to create wealth with minimum risk and easy-to-learn methods.

Ted Thomas is America’s Leading Authority on Tax Lien Certificates and Tax Deed Auctions, as well as a publisher and author of more than 30 books. His guidebooks on Real Estate have sold in four corners of the world. He has been teaching people just like you for over 30 years how to buy houses in good neighborhoods for pennies on the dollar. He teaches how to create wealth with minimum risk and easy-to-learn methods.