A Beginner’s Guide to Tax Lien Investing

You can unlock the hidden potential of tax lien investing and embark on a journey to financial freedom. In this beginner’s guide, we will peel back the layers and reveal the secrets of this intriguing investment strategy. Like peering behind a curtain, you will gain insight into the inner workings of tax lien investing, allowing you to make informed decisions and maximize your returns.

As the saying goes, ‘knowledge is power,’ and by delving into the world of tax lien investing, you will arm yourself with the tools necessary to take control of your financial future.

Discover the step-by-step process of getting started, from researching properties to bidding and purchasing. Uncover the potential risks and rewards that await you on this path, and learn how to navigate them with confidence.

With the right knowledge and a willingness to learn, tax lien investing can open doors to a world of opportunity. So, take the reins and seize control of your financial destiny as we unveil the secrets of tax lien investing in this beginner’s guide.

Key Takeaways

- Tax lien investing requires time and resources for learning, including classes and learning systems.

- Beginners can start by contacting their local County to find out if they sell tax lien certificates or tax deeds.

- Property inspections are crucial to avoid buying underwater or unsellable properties.

- Research is necessary to understand tax lien rules and rates in different areas.

What is Tax Lien and Tax Deed Investing?

To understand tax lien investing, you need to know that it involves purchasing tax lien certificates or tax deeds from local County governments or other jurisdictions as a way to potentially acquire properties or earn a return on investment when property owners redeem the certificates.

This type of investment has both benefits and drawbacks. On the positive side, tax lien investing allows for a direct investment with the county and the potential to acquire properties at a lower cost. However, there are also drawbacks to consider, such as the lack of control over the property and potential bidding competition.

To be successful in tax lien investing, it’s important to conduct due diligence and thorough research on the properties. This includes researching and inspecting properties before buying tax liens to avoid purchasing underwater or unsellable properties.

Getting Started Investing in Tax Liens

Ready to dive into the world of tax lien investing? Let’s start by finding out if your local County sells tax lien certificates or tax deeds. This is an important step in getting started.

Once you’ve determined what your County is selling, you can begin your journey into tax lien investing. Here are a few key things to consider:

- Choosing the right county: Not all counties are created equal when it comes to tax lien investing. Some counties may have more opportunities for profitable investments than others. Researching and choosing the right county to invest in is crucial for success.

- Finding mentors or coaches: Learning from experienced investors can greatly accelerate your learning curve. Seek out mentors or coaches who have experience in tax lien investing. They can provide guidance, advice, and help you avoid common pitfalls.

By taking these steps and doing your due diligence, you’ll be well on your way to becoming a successful tax lien investor.

Researching Tax Lien Properties

Start by researching properties with tax liens in your desired county to find potential investment opportunities. This is a crucial part of the process to ensure you’re making informed decisions.

One way to find tax lien properties is by checking the county’s newspaper or website, where they often list properties with tax liens available for auction or sale.

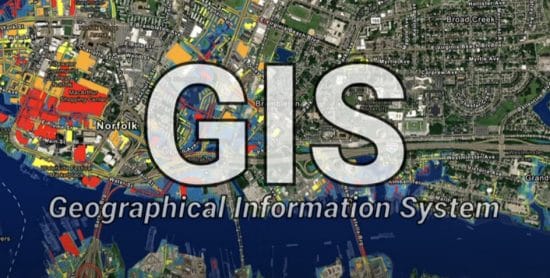

Additionally, you can utilize GIS mapping systems to conduct virtual property inspections, allowing you to assess the condition and value of the properties without physically visiting them. These mapping systems provide detailed information and imagery that can help you identify potential risks or opportunities. However, don’t rely solely on online images; physically view the property or have someone you trust do it for you.

By thoroughly researching and inspecting properties, you can avoid purchasing underwater or unsellable properties and increase your chances of a successful tax lien investment.

Bidding and Purchasing Tax Delinquent Real Estate

Ensure you thoroughly understand the bidding process and requirements before purchasing a tax lien property. Tax lien auction strategies play a crucial role in your success as a tax lien investor. It is essential to develop a strategy based on your goals and risk tolerance.

One common strategy is to focus on properties with a high likelihood of redemption, as this ensures a steady return on investment. Another strategy is to target properties with the potential for successful property flipping. These properties may require some renovations or improvements, but they offer the opportunity for higher profits.

When bidding, it’s important to set a maximum bid amount and stick to it. This will help you avoid overpaying for a property and ensure that you maintain control over your investment.

By understanding and implementing effective bidding strategies, you can increase your chances of successful tax lien investing.

Potential Risks and Rewards of Tax Lien Investment

Be aware of the potential risks and rewards associated with tax lien investing. Before diving into this venture, it’s crucial to conduct thorough property research and understand the tax lien regulations. Each state and county has its own set of rules for tax lien auctions, so it’s essential to familiarize yourself with these regulations.

While tax lien investing offers direct investment with the county and the potential for property acquisition, approach tax lien investing with caution and be diligent in your research to minimize risks and maximize rewards.

Frequently Asked Questions

Are tax lien certificates and tax deeds the same thing?

Tax lien certificates and tax deeds are not the same thing. While both involve investing in properties with delinquent taxes, they have different outcomes.

- Tax lien certificates allow investors to purchase a lien on a property and earn interest when the owner redeems the certificate.

- Tax deeds give investors ownership of the property if the owner doesn’t pay their taxes.

Understanding these distinctions is crucial to navigate the risks of tax lien investing and the tax lien foreclosure process effectively.

How long does it typically take for a property owner to redeem a tax lien certificate?

The redemption period for a tax lien certificate can vary depending on the state and county, but it typically ranges from a few months to a few years. During this time, the property owner has the opportunity to redeem the certificate by paying the outstanding taxes, plus any accrued interest.

It’s important to note that the redemption period starts from the date of the tax lien auction. To find out the specific redemption period for a particular area, research the local tax lien rules and regulations.

Can tax lien investors make improvements to the properties they acquire?

Yes, tax lien investors can make improvements to the properties they acquire. Property renovations are a common strategy used by investors to enhance the value of the property. By making necessary repairs and upgrades, investors can increase the attractiveness of the property and potentially sell it for a higher price.

However, it’s important for investors to carefully consider the costs and benefits of property renovations and ensure that they align with their investment goals.

Are there any restrictions on who can participate in tax lien auctions?

Anyone can participate in tax lien auctions as long as they meet the eligibility criteria set by the county or state. Restrictions on participation are rare, but some jurisdictions may require participants to be at least 18 years old and have a valid identification. Additionally, some counties may require participants to register or provide proof of funds to ensure serious bidding.

It’s important to research and understand the specific rules and requirements of the county or state where you plan to participate in tax lien auctions.

Conclusion

Tax Lien investing can be incredibly rewarding if you know the rules and do your homework.

Tax lien certificates pay interest rates of 16%, 18%, 24% or even 36%, and if you don’t get paid, you get the property. This is a low-risk, high-yield passive investment. You receive your return on investment from the government, and your investment is secured by real estate.

Unlike tax lien investing, when you invest in tax deeds, you’re purchasing the property outright. The bidding begins at the back taxes, and you can buy real estate at a tax deed auction for 10, 20, or 30 cents on the dollar of the tax assessed value.

Both tax lien and tax deed properties come mortgage-free. The County wipes the mortgage out. Imagine acquiring real estate for pennies on the dollar and getting it without a mortgage!

Would you like to know more about tax lien investing? Ted Thomas provides full support and complete training with home study courses, Q&A webinars, live tutorials, workshops, web classes, personal coaching with certified coaches, and an interactive map and auction calendar research tool that allows you to visit each county online to find the details about upcoming auctions.

Want to earn massive income from bargain real estate investing? Would you like to buy mortgage-free homes for pennies on the dollar? Or earn double-digit interest rates secured by real estate? Then get started today with this Free Gift.

Ted Thomas is America’s Leading Authority on Tax Lien Certificates and Tax Deed Auctions, as well as a publisher and author of more than 30 books. His guidebooks on Real Estate have sold in four corners of the world. He has been teaching people just like you for over 30 years how to buy houses in good neighborhoods for pennies on the dollar. He teaches how to create wealth with minimum risk and easy-to-learn methods.