What is a tax lien? The simple answer is: it’s an obligation a delinquent tax payer has to the local government (typically a county or other local municipality) to pay past due taxes on property.

How can you as an investor profit from tax liens? By purchasing tax lien certificates.

In this video, Ted helps answer the question, What is a tax lien certificate?

What is a tax lien? A tax lien is a legal claim imposed by the government on a property when the owner fails to pay their property taxes. It is a way for the government to ensure that they receive the unpaid taxes owed to them.

When a property owner fails to pay property taxes, the local taxing authority, typically the county government, can place a lien on the property. This lien serves as a claim against the property and gives the government the right to collect the unpaid taxes, along with any accrued interest and penalties.

By law the local government must collect the money needed to provide public services from each property owner and does so via property tax dollars. If the tax debt cannot be collected from the property owner, the local or municipal government will offer a tax lien certificate at a tax auction where investors bid on the interest rate.

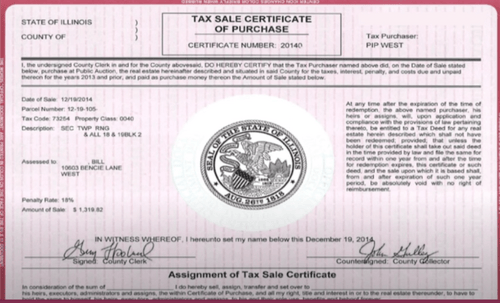

A tax lien certificate is a document issued by the government to a successful bidder or investor who purchases a tax lien on a property through a tax lien auction or sale. It represents the investor’s claim on the unpaid property taxes and serves as evidence of their ownership interest in the lien.

When a property owner fails to pay their property taxes, the local taxing authority may sell the tax lien to investors in order to recover the unpaid taxes. These tax lien sales are often conducted through auctions, where interested parties bid on the liens.

For the investor this system provides a safe, secure and predictable investment in government issued certificates with a maximum annual interest rate, set by the state government, which can be 16%, 18%… up to 25% annually.

Once an investor successfully purchases a tax lien, they receive a tax lien certificate as proof of their investment. The certificate typically includes information such as the property owner’s name, property description, the amount of the unpaid taxes, and the interest rate or penalty associated with the lien.

The tax lien certificate also outlines the rights and responsibilities of the investor, including the redemption period during which the property owner can pay off the outstanding taxes and reclaim the property. If the owner fails to redeem the property within the specified timeframe, the investor may have the option to initiate foreclosure proceedings and potentially gain ownership of the property.

Tax lien certificates can provide investors with the opportunity to earn interest on their investment if the property owner redeems the property. However, it’s essential to understand the local laws and regulations governing tax liens and to conduct thorough research before investing in tax lien certificates. Note that specific procedures and requirements for tax lien certificates can vary between jurisdictions.

When investing in tax certificates you’re making an investment secured by the real estate on which the taxes are due. If property owners don’t pay their delinquent taxes, you can can make a legal claim on (get possession of) the property for only the past due taxes and fees… basically for pennies on the dollar! That means that if you bought the certificate and the property taxes are not paid, you could end up owning the property for just the back taxes and fees owed the local government.

Here are some points that highlight why tax lien investing can be considered relatively safe:

Priority of the Tax Lien: When a tax lien is placed on a property, it typically takes priority over other liens or mortgages on the property. This means that in the event of foreclosure, the tax lien holder is generally first in line to recoup their investment, giving them a higher chance of recovering their funds.

Government Backing: Tax liens are issued by government authorities, providing a level of assurance to investors. Since they are backed by the government’s authority to collect taxes, the chances of recovering the invested amount are higher compared to private investments.

Fixed Interest Rates: Tax lien certificates often come with fixed interest rates, which means that regardless of economic conditions, the investor will receive a predetermined rate of return. This fixed return provides stability and helps mitigate some of the risks associated with market fluctuations.

Redemption Period: Property owners usually have a specified redemption period to pay off the delinquent taxes along with any interest or penalties. During this time, the tax lien investor earns interest on their investment, and if the property owner redeems the property, the investor receives their principal amount back.

Limited Competition: Tax lien auctions often have limited participation compared to other investment markets, reducing the level of competition. With fewer bidders, investors may have a higher likelihood of securing tax liens at reasonable prices.

Tangible Asset: Tax lien investing involves real estate, which is a tangible asset. Even if the property owner fails to redeem the tax lien, the investor may have the opportunity to foreclose on the property and potentially gain ownership. Real estate is generally considered a valuable long-term asset that tends to appreciate in value over time.

Local Government Control: Tax liens are typically managed and regulated by local governments. These authorities enforce specific rules and procedures to ensure transparency and protect the rights of investors.

While tax lien investing offers certain advantages, it is crucial to conduct thorough research, understand the risks involved, and seek professional advice.

So, what is a tax lien certificate anyway? Real estate investing via tax liens is considered by many as the safest investment you can make.

Here are some unique features about tax lien investing that benefit the investor:

When thinking about this question, investors take two approaches:

Traditionally most tax lien certificates and tax deeds sales were held at a public auction. Today many of these government auctions are done online. Investors can buy tax lien certificates from almost anywhere in the world using the internet.

After over 30 years of instructing others on the secrets to successfully investing in government auctioned tax lien certificates and tax deeds, Ted Thomas has presented at hundreds of wealth building seminars, held over a hundred workshops and amassed thousands of hours of recorded material that he has edited into a comprehensive learning system.

This system includes presentations from Ted Thomas and many other experts with first-hand personal experience investing in tax liens and tax deeds.

For more information about Tax Lien States Click Here

Get a free gift from Ted & see for yourself what investing in real estate with delinquent property taxes can do for you.

Ted Thomas is America’s Leading Authority on Tax Lien Certificates and Tax Deed Auctions, as well as a publisher and author of more than 30 books. His guidebooks on Real Estate have sold in four corners of the world. He has been teaching people just like you for over 30 years how to buy houses in good neighborhoods for pennies on the dollar. He teaches how to create wealth with minimum risk and easy-to-learn methods.

Ted Thomas is America’s Leading Authority on Tax Lien Certificates and Tax Deed Auctions, as well as a publisher and author of more than 30 books. His guidebooks on Real Estate have sold in four corners of the world. He has been teaching people just like you for over 30 years how to buy houses in good neighborhoods for pennies on the dollar. He teaches how to create wealth with minimum risk and easy-to-learn methods.

I understand I can easily unsubscribe with the link in your e‑mails.

Note: We respect your privacy and will never rent or sell your information.

Copyright © 2024 – Jones & Trevor Marketing, Inc. ALL RIGHTS RESERVED